The Firehose

President Trump’s first week in office was a firehose of executive action and policy news, including actions that are focused on restricting immigration, expanding energy production, and rolling back climate regulation. For those interested in the details, the White House publishes all executive actions here.

Tariffs have been a topic of President Trump’s post-inauguration press conferences, but as of now he hasn’t taken significant tariff action other than directing his cabinet secretaries to “investigate the causes of our country’s large and persistent annual trade deficits in goods,” and “recommend appropriate measures, such as a global supplemental tariff or other policies, to remedy such deficits.” Over the weekend President Trump announced a 25% tariff on Colombian imports over their refusal to accept flights of deported migrants, but didn’t sign the order after Colombia agreed to accept deportation flights.

We’ve also had two significant infrastructure announcements over the last week. First, The Stargate Project is a $500bn artificial intelligence infrastructure venture spearheaded by OpenAI, Softbank, and Oracle. Starlink will be focused on data center construction in Texas. Second, Saudia Arabia announced plans to invest $600bn in US over Trump’s second term, although we haven’t been able to find specifics on the type of investment that is planned.

The combination of pro-business policy action and lack of tariff action from Washington DC and supportive economic data had pushed US equities back near all-time highs, but news that DeepSeek, a Chinese artificial intelligence startup, has demonstrated a breakthrough AI model resulted in a significant sell-off for US tech stocks pre-market. As of 8:30 this morning, NVIDIA was down -11% and the Nasdaq Index had declined -3.5%. Chinese equities, as measured by the Hang Seng, was trading up approximately +1%, and the global stock market (MSCI ACWI) was down about 2% overall.

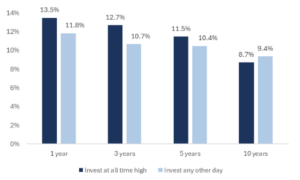

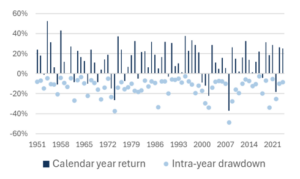

The beginning of the year is as good of a time as any to revisit expectations and we believe equity investors should hold these two ideas in their heads simultaneously: (1) All-time-highs have been good times to buy equities (Fig. 1), and (2) an intra-year drawdown of 10% or more is completely normal and should be expected (Fig. 2). Today’s sell-off is a small reminder of those ideas.

Fig. 1: Average annualized return when investing at all-time highs (S&P 500)

Source: Bloomberg, Mill Creek. 1989 – 2024

Fig. 2: Calendar year returns and intra-year drawdowns

Source: Bloomberg, Mill Creek.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.